PAYROLL MANAGEMENT SYSTEM FOR CANADA

Automate payroll for accuracy and compliance.

High data volume? Complex Canadian regulations? No problem. Streamline and simplify your Canadian payroll processes with an agile, automated, and continuous calculation engine that improves accuracy and compliance.

The world¡¯s leading companies trust ²ÝÝ®ÊÓƵ.?All Customer Stories

BENEFITS

Your payroll workflow, simplified.

Today¡¯s payroll teams are slowed by manual processes, input errors, complex regulations, and disconnected systems¡ªwhich can lead to overworked, disengaged staff. With ²ÝÝ®ÊÓƵ, you can change that.

Increase payroll software Canada accuracy.

Automate 90% of payroll transactions with a single system for all your data related to HR, remuneration, leave, time, and payroll.

Ensure Canada compliance at every level.

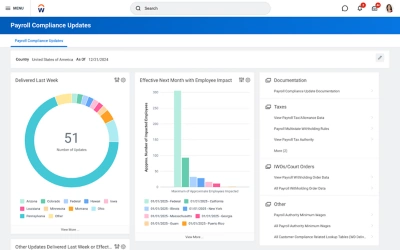

Deliver on change and evolving regulations without compromising accuracy and compliance. Mitigate risk via the compliance updates dashboard.

Manage complex scenarios.?

Empower your team to navigate complex Canadian calculations, new rules, and specific reporting requirements without waiting on service providers.

WHAT YOU CAN DO

Boost efficiency. Enhance accuracy. Increase control.

Our Payroll for Canada provides provides the capabilities you need to simplify and streamline payroll processes. Easily manage calculations, compliance, and reporting with tools your team controls¡ªin a single platform that keeps your sensitive data secure.

-

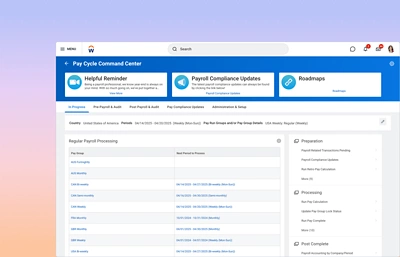

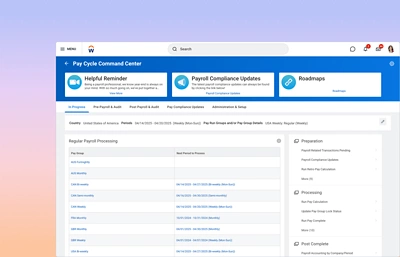

Continuous payroll processing?

-

Configurable audits?

-

Automatic tax, garnishment, and legislative updates?

-

AI Record of Employment (ROE) processing?

-

Year-end processing?

-

Tax remittance, worker's compensation, and health tax reporting?

-

AI payroll prompt recommendations?

COMPLIANCE AND AUDITING

Results you can trust.

When you rely on complex, manual payroll processes, it can be easy for errors to slip through the cracks¡ªespecially if high volumes of data are involved. With ²ÝÝ®ÊÓƵ Payroll for Canada, our AI-driven features do the heavy lifting to keep your payroll spot-on, providing peace of mind and fostering trust and compliance within your organisation.?

Stay ahead of compliance.

Our single, consistent security model across HR and payroll protects your sensitive data and ensures that users can only access the information they are authorized to access. With support for complex rules, automatic tax updates via cloud model, and other built-in compliance functionalities, we help you stay ahead of the latest regulations.

Audit smarter with AI.

Use smart audit capabilities to support compliance and improve payroll accuracy¡ªwithout compromising processing time. Our tools help you simplify audit processes by applying AI to surface anomalies in payroll results. And our unified system platform makes it easy to quickly identify causes for errors with payroll source transactions.?

Canada Payroll Management System FAQs

How does ²ÝÝ®ÊÓƵ ensure payroll compliance with Canadian province and territory regulations?

²ÝÝ®ÊÓƵ's Canada payroll system supports compliance via regulatory updates and expert monitoring. Its configurable framework, embedded controls, and audit trails in the system support adherence to diverse provincial and territorial jurisdictions, helping your payroll management be always compliant.

Can ²ÝÝ®ÊÓƵ Payroll for Canada help with tax calculations and reporting?

Yes, ²ÝÝ®ÊÓƵ¡¯s Canada payroll system automates complex tax calculations using the latest regulations and a configurable engine. This payroll management system uses HCM and absence and time data in the same system for accuracy, providing robust reporting and employee self-service for TD1 and TD1X, simplifying your entire payroll process.

How does payroll auditing work in ²ÝÝ®ÊÓƵ, and what reports are available?

²ÝÝ®ÊÓƵ¡¯s Canada payroll system features continuous, embedded auditing with always-on audit trails and real-time "smart audits" for exceptions. This system offers built-in audit reports, dashboards, and flexible reporting for data integrity, centralizing your payroll audit needs.

What are the benefits of automating Canadian payroll processes with ²ÝÝ®ÊÓƵ?

Automating payroll with ²ÝÝ®ÊÓƵ¡¯s Canada payroll system boosts accuracy, reducing errors, and improves efficiency with streamlined, continuous calculations. This payroll management system also delivers cost savings, stronger compliance, faster data-driven decisions, and an enhanced employee self-service experience.

What compliance features are built into ²ÝÝ®ÊÓƵ Payroll for Canada?

²ÝÝ®ÊÓƵ Payroll for Canada lets you leverage configurable frameworks built for payroll and compliance and designed to be owned by payroll, giving you the flexibility to accommodate specific business needs, complex payroll calculations, and evolving Canadian regulatory requirements.

?

How does ²ÝÝ®ÊÓƵ Payroll for Canada integrate with other HR and finance systems?

²ÝÝ®ÊÓƵ¡¯s Canada payroll system integrates natively in its unified platform, sharing real-time data with HCM and Financials. For external systems, our payroll solution offers robust integration tools, pre-built APIs for global payroll partners, and banking connections, supporting a connected system.

?

Is ²ÝÝ®ÊÓƵ Payroll for Canada compliant with industry standards like SOC 1 or the Canada Privacy Act?

Yes, the ²ÝÝ®ÊÓƵ platform, including its payroll system, meets many standards like SOC 1, SOC 2, & ISO 27001, verified by audits. Our system supports the Canada Privacy Act, and GDPR compliance via EU Cloud Code of Conduct adherence & certifications like TRUSTe & ISO 27701, supporting your data is secure.

?

How does ²ÝÝ®ÊÓƵ handle payroll systems for a multinationals and a global workforce?

²ÝÝ®ÊÓƵ's payroll systems manages global payroll on a unified platform with native processing and partner integrations via Global Payroll Connect. This system supports local compliance, centralized control, consolidated global reporting, and a consistent user experience for your global entire workforce.

?

See how we help you succeed.